Hey!

Welcome back to my 9th monthly investor-style update, where I transparently share the highs and lows of running my business and personal development.

April was a quieter month on the surface as I took some downtime, which meant less momentum to report. That said, we're still growing month over month, and I’m excited to be recharged and back in action.

If you missed any of the past updates, you can catch up here:

In this email, you'll find:

✅ Goals, sales, successes, and challenges.

✅ Financial data.

✅ Behind-the-scenes decisions, strategies, and pivots.

This isn't just a newsletter - it's an open book. Let’s dive in! 👇

TL;DR

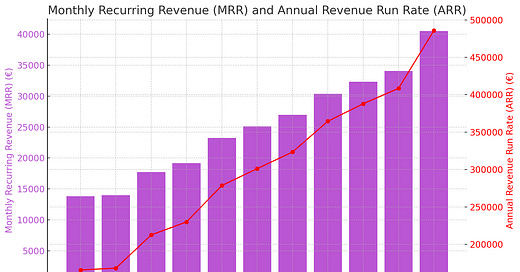

Revenue Growth: Revenue in April increased 5.3% over March so we closed out the month strong. That being said, I had initially predicted 14.4% growth month over month for March to April, but inevitably between annual leave and everything I pushed out a few pieces to May. We have 18.8% growth for May as a result so far. (Some of this is not MRR which is worth noting because it might look like churn in future months)

Sales Pipeline: Our pipeline continues to perform well, we closed all proposals that we sent out in March so we had an insane 100% close rate.

Customer Retention: 0% churn from Jan-April which was great news! It’s now been 5 months since we experienced churn. I only have an orange flag over 1-2 clients that may need to churn for financial reasons rather than experience working with us.

Market Trends: Last month I spoke a lot about USA tariffs and market spend, but that’s becoming less of a worry now. People have made decisions to cut their marketing into the USA or just adjust to the costs. Early days in terms of business impact yet, but for most - their expanded spend into Europe is closing the costs for them.

Scaling Up: Last month I noted that scaling means shifting from being the person who ‘does everything’ to being the person who ‘builds the machine.’ I’ve really tried to hand over as much as possible to my team this month again but I am seeing a lot of areas of downfall, primarily in relinquishing more trust and control and tighter comms.

Key Metrics:

We’re coming into the summer season soon which is always quieter than anticipated. I am hopeful that it will be stronger than usual but I will suspect that we will have some plateau.

Here’s what the graph panned out to:

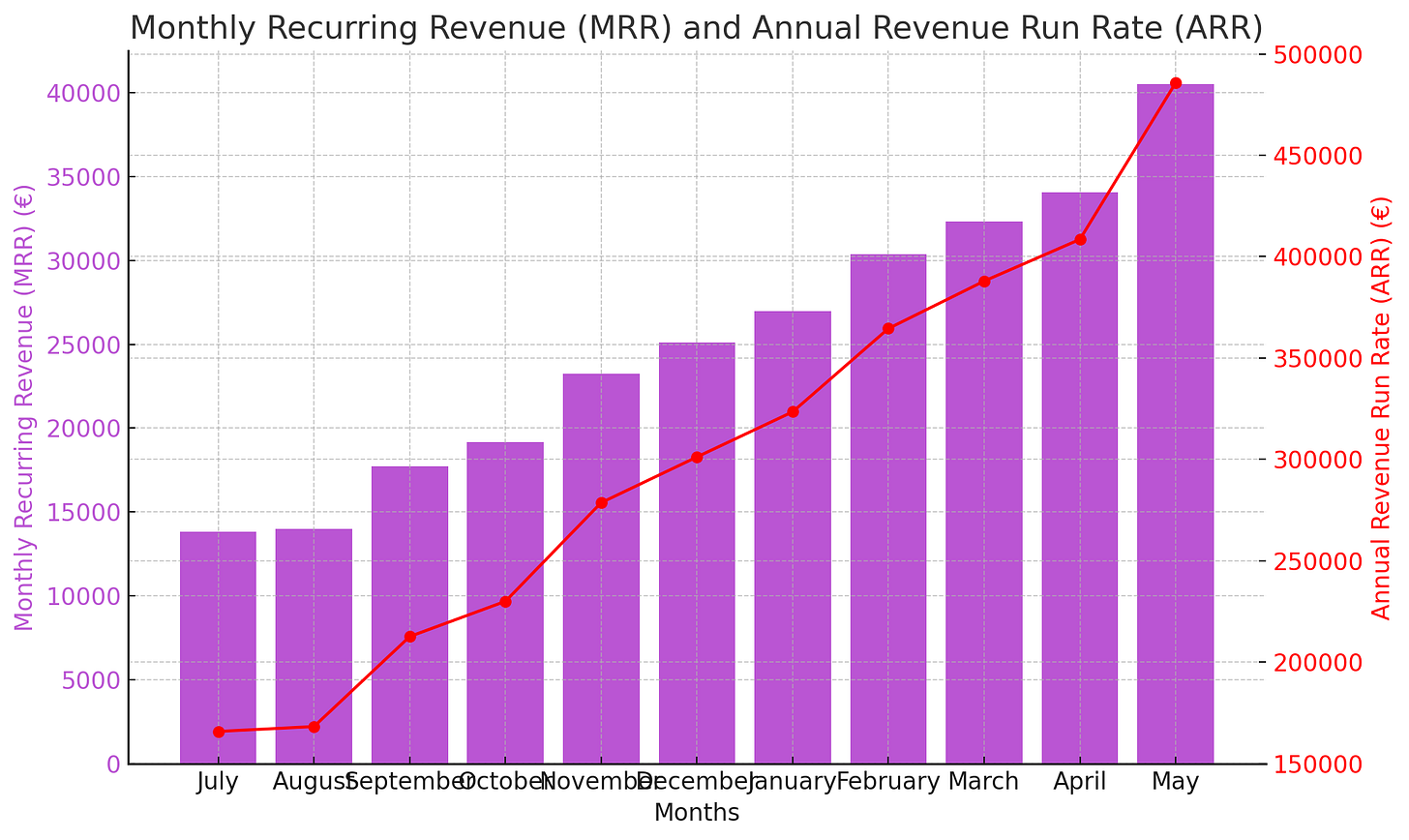

Again this month I am seeing the same pattern as I predict growth. Below is the graph from last month. And you can see just how much revenue doesn’t get closed when onboarding moves slower than anticipated and revenue gets pushed out. We experienced that a lot on February and March and it made their actual closed revenue lower than we had modelled. This is good to know for cashflow, revenue can often be a lagging metric and we feel some of that lag more as we grow. I am continuously at an error rate of a few % in terms of actual closed revenue.

Here is what we can predict the business will look like in April 2026 if we continue to grow at 10% month-over-month and have 0% churn.

Projected May 2026 10% Month Over Month Growth:

Projected MRR: €120k

Projected ARR: €1.4m

Projected May 2026:

Here’s an updated forecast showing projected growth with:

📈 10% Month-over-Month growth but also:

🔻 5% Month-over-Month churn

Projected MRR: €70k

Projected ARR: €835k

This is one of my first few months where the projections are notably different to my previous months. This is normal at this stage of growth and I move things between months for resourcing etc.

Team & Expenditures:

We made a deliberate decision to expand the team, knowing it would temporarily compress our margins. The goal: build capacity to handle more clients and restore our 40% target margin over time. In March and April it was 26.7% but in May we’re set to improve to 28.36%. I am placing a bet that with more resources I can close more deals and have more bandwidth. The team currently has capacity to grow back to our original margins.

Diversification of Revenue Streams:

Pipeline:

Pipeline is really strong with our partnerships model. Over the last few months with every scrap of an idea I have had to diversify revenue, the only thing that has panned out is the overflow agency experiment outlined in the last few emails. It worked great and is pretty fleshed out now and seamless.

I didn’t overthink diversifying in April and May as I have a couple of really fun completely different businesses in the works that are partnerships with a couple of folks who are already clients which is amazing. Hopefully by next months email I will have signed off the paperwork that let’s me talk more about these.

Marketing Experiment Results:

Team Growth Experiment:

I am going to chat with the team this week and give them a €1000 budget to promote https://lemon7.ie and see what they come back with. I think that will be a really interesting experiment for May.

Email Marketing Evolution:

Pretty stable numbers in terms of the email. I didn’t do much promotion of it in the last month. Need to get that back in gear this month also.

No other active experiments are live right now. As mentioned above the next real marketing avenue for scale is the paid advertising piece and I will be including that in this growth model as well.

What I feel good about:

Our sales pipeline is stronger and more predictable than it’s ever been. We’re hitting an almost constant close rate on every proposal, which gives me a lot of confidence going into Q3.

I’ve finally started to diversify the pipeline, moving beyond word of mouth and audience-driven referrals into partner-based acquisition, and it’s already showing signs of traction.

We’ve had 0% churn for 4 straight months, which is both a relief and a sign that the work we’re doing is consistently valuable to our clients.

What I Am Freaked Out About

Margins are tighter than usual due to new hires and investments, dropping to 26.7% in April and 28% in May. Cashflow is healthy though and people are paying on time.

There’s still a lot riding on just two lead sources, and while partnerships are growing, I’m not yet at the diversified pipeline I know we’ll need to hit the next level.

Personal & Fun Highlights in April

I went away for a wedding in Italy this month and took as much downtime as possible. It was an unbelievable location. If you’re ever in Sicily, head to Scopello - it was truly amazing.

Health & Wellness Goals & Performance

Right well this is clearly a step back after going on holidays… I slipped a bit after my holiday (who doesn’t?), but I’m not back to square one.

I didn’t reverse to February completely! I really need to dig into my muscle mass as it will help figure out all the other metrics. Focusing on all your health metrics is tough. I am going to hone in on muscle mass for the rest of May and just zone in on seeing what other metrics that impacts. It will be interesting to see.

What’s next and What I need help with:

Clients:

If you know someone looking for paid advertising or social media management we’ve streamlined out pricing and proposal requests. Those can be shared here.

Growth Ideas:

If you’ve scaled an agency with paid media and are willing to share lessons (or mistakes), I’d be all ears. Please feel free to send those my way.

April Sign Off:

Thank you for taking the time to follow along on this journey. If you have questions, feedback, or just want to chat, hit reply - your email will land directly in my inbox.

Warm regards,

Jen